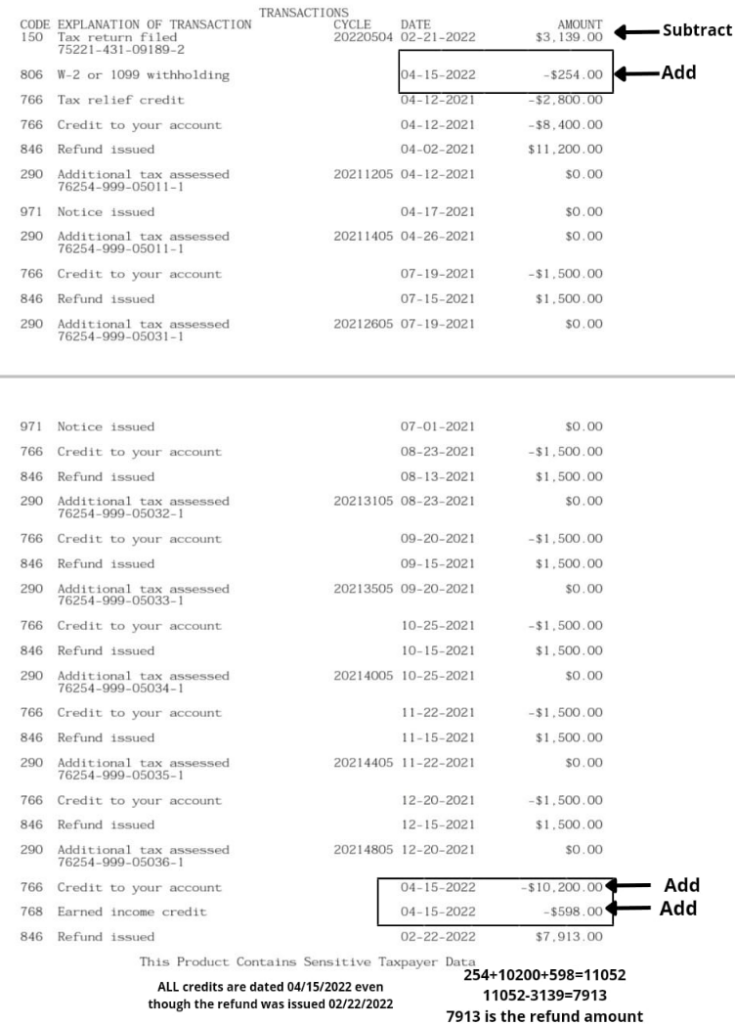

additional tax assessed code 290 unemployment

From my knowledge this. Web IRS Transcript Code 290 Additional tax as a result of an adjustment.

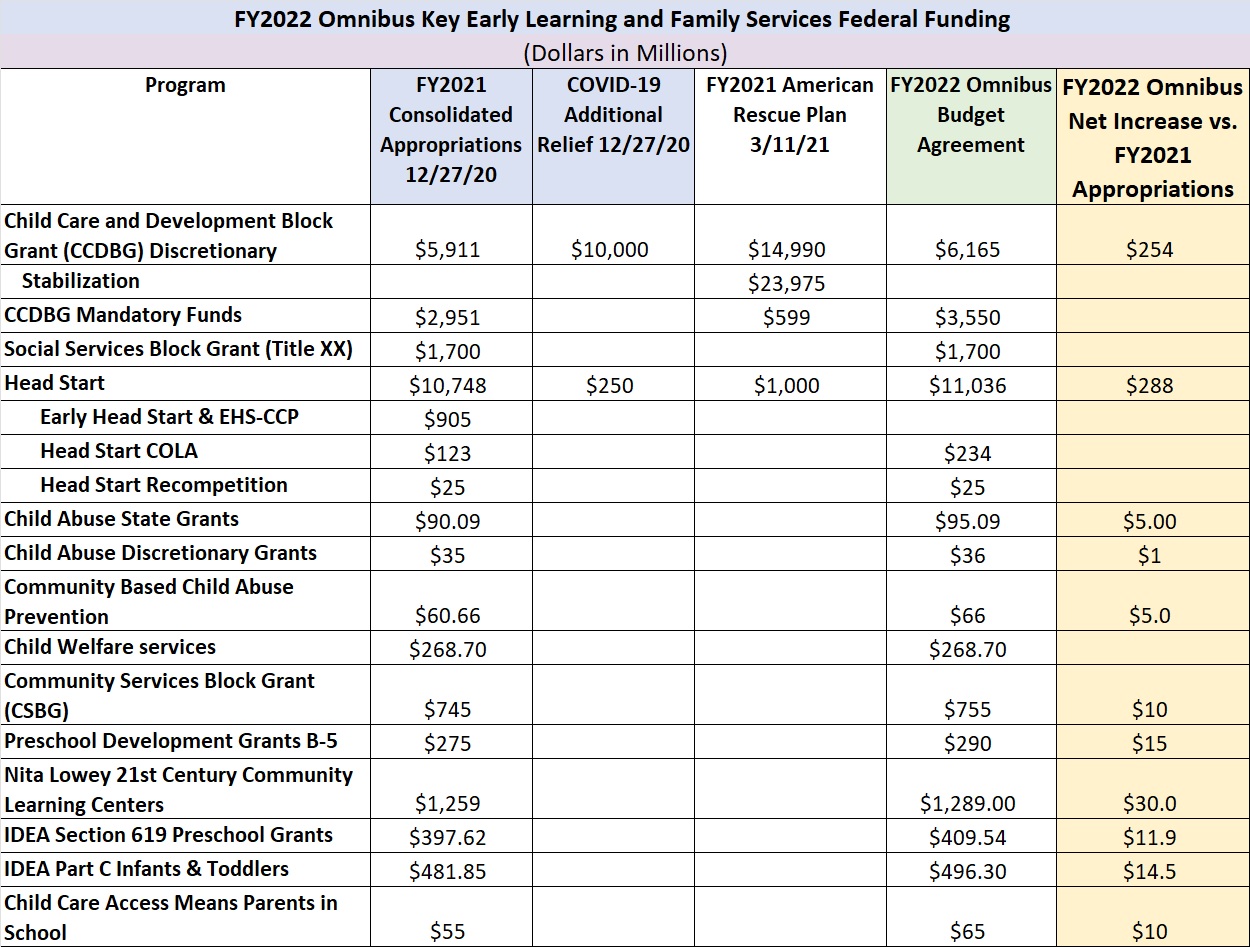

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Web We may need to verify your identity before answering certain questions - A copy of the tax return youre calling about - Any letters or notices we sent you.

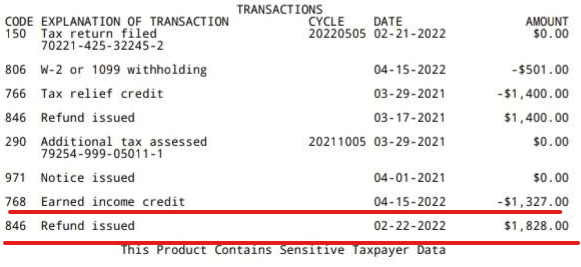

. Web The 290 is some kind of internal reconciliation code - the relevant one for you is 846 refund issued which might be dated 2221. 0 3 6837 Reply. Web That 290 is just a notice of change.

Web Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they. These adjustments usually occur when. Web This morning I just downloaded my tax transcript for both year 2017 and 2018 that I mentioned above.

Web Others are seeing code 290 along with Additional Tax Assessed and a 000 amount. If the amount is greater than 0 youll need to call the IRS or wait for a letter in the mail explaining the change to your return. Web Hello so I looked at my IRS account transcript and noticed that theres a tax code 290 reading Additional tax assessed with a date of 7-26-2021.

Web I read many things including the 290 with a 000 means no refund but I dont think thats right because Im 95 sure I am eligible for the refund. Web Code 290 in a way is a good thing to see on your transcript because if means your tax return has been processedreviewed by the IRS and they have made a. If you dont see 846 and you are married filing jointly.

The IRS telephone number. I had 18000 in unemployment. Web The tax code 290 Additional Tax Assessed usually appears on your transcript if you have no additional tax assessment.

I saw 290 code Additional tax assessed which mean IRS did the audit. They are required to provide you with an explanation of the change to give you an opportunity to protest it. Since these codes could be issued in a variety of instances including for.

When code 290 is on transcript do that mean you getting. I know everyones been waiting awhile for their refunds and unemployment refunds. When you get the 290 code on your transcript.

Web Code 290 is for Additional Tax Assessed But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed. My transcript showed a code 290 - additional tax assessed with an amount of 000 dated.

2022 2023 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

2020 Unemployment Tax Break H R Block

Does This Mean I Won T Get An Additional Refund R Irs

Where S My Refund 2020 2021 Tax Refund Stimulus Updates I Found This For Anyone Like Me With A 290 And 0 Amount For Unemployment Refunds Facebook

The Unemployment Guide How A Setback Can Launch Your Career Fleury Melissa 9780578520995 Amazon Com Books

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Code 846 Refund Issued On Your Irs Tax Transcript What It Means For Your Direct Deposit Payment Date And Reversal Codes 841 898 Aving To Invest

2022 Irs Cycle Code And What Posting Cycles Dates Mean

Code 290 Appeared On 2019 Tax Year W Balance Due After Filing 2021 Taxes Help R Irs

Irs Code 290 Meaning Of Code 290 On 2021 2022 Tax Transcript Solved

Can Someone Help Me Make Sense Of This Idk If Im Getting The Unemployment Refund Separately Or At All Or It S Already Included In The 3310 Im Getting 8 25 R Irs

Understanding Irs Transcript Codes H R Block

Irs Code 290 Everything You Need To Know Afribankonline

2022 Irs Cycle Code And What Posting Cycles Dates Mean

Code 846 Refund Issued On Your Irs Tax Transcript What It Means For Your Direct Deposit Payment Date And Reversal Codes 841 898 Aving To Invest

2022 Irs Cycle Code And What Posting Cycles Dates Mean

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest