pay utah state sales tax online

You can apply for a license online at taputahgov Tax Commission only. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

See also Payment Agreement Request.

. What States Have Sales Taxes. File and Pay Online. Every seller with an established presence in Utah see Nexus Filers below must have a Utah Sales Tax License.

See Utah Sales Use Tax Rates to find your local sales tax rate. For your convenience we have included a. Online payments may include a service.

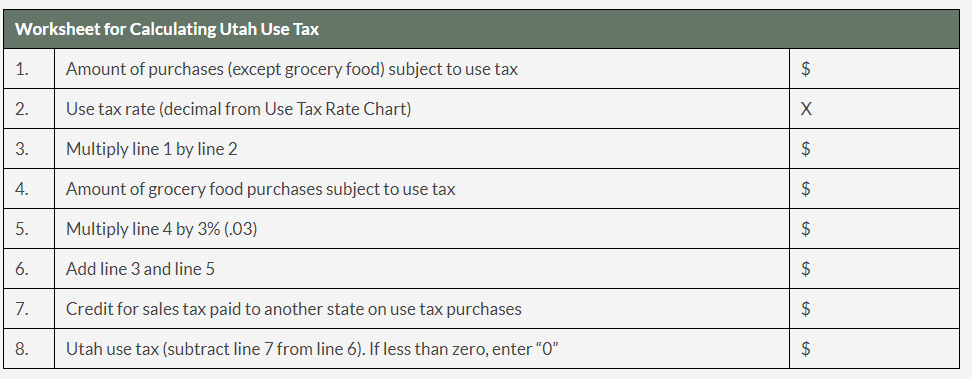

Use tax is a tax on goods and taxable services purchased for use storage or other consumption in Utah during the taxable year and applies only if sales tax was not paid at the time of. How to Pay Utahs Sales Tax. You can register for a Utah sellers permit online through the Utah State Tax Commission.

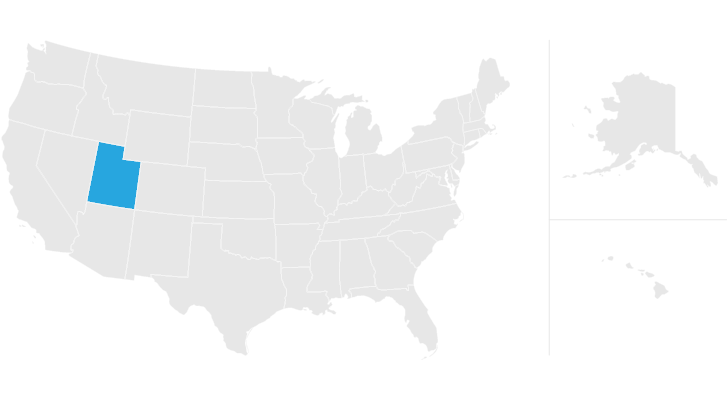

You can also pay online and avoid the hassles of. As listed by the Sales Tax Handbook the state imposes a 685 percent sales tax rate on customers for purchasing a vehicle. Utah has a 485 statewide sales tax rate but also has 126 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2115.

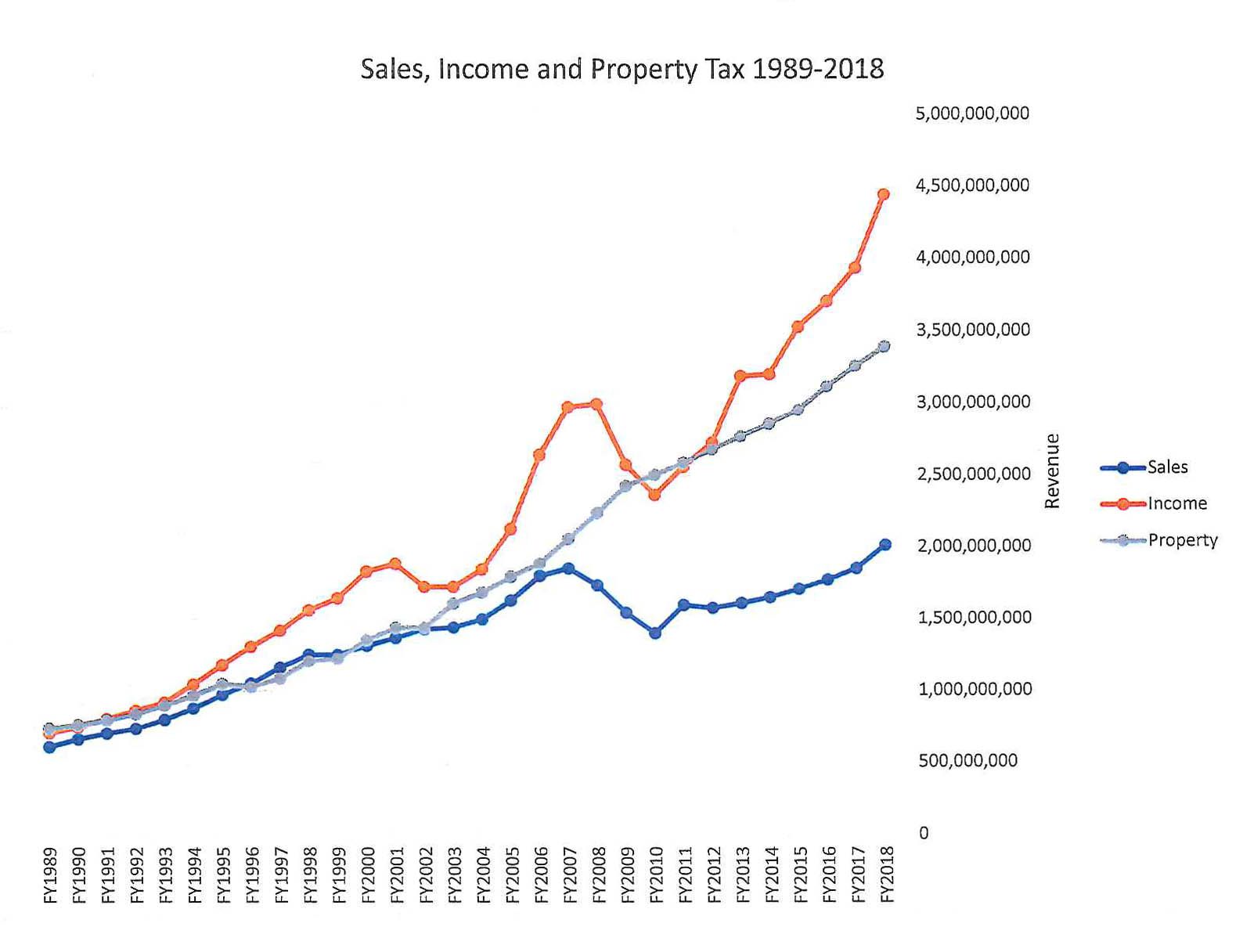

The base rate of sales tax in Utah is 47 but the most common range of Utah sales tax including the county sales tax rate is 6-725. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Utah requires businesses to file sales tax returns and submit sales tax payments online. How to File and Pay Sales Tax in Utah. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

You are now ready to make your payment. You would typically only collect sales tax for another state if. Note that sales tax due may be adjusted and.

You may pay your tax online with your credit card or with an electronic check ACH debit. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. For security reasons TAP and other e-services are not available in most countries outside the United States.

Please note that for security. Multiply the rate by the purchase price to calculate the sales tax amount. The countys sales tax rate is also 645.

The most you can pay in state sales taxes for a. You do not need to pay sales tax for last month 201000 because you had. You have two options for filing and paying your Utah sales tax.

To apply youll need to provide the Tax Commission with certain information about your business. In other words the Utah County sales tax rate will be 1450 per 100 of taxable value in 2022. On that confirmation page above note that you can either select Pay Online or Paper Check.

For retailers who sell their goods online all orders and deliveries within the state are subject to that states sales tax. To remain compliant register for sales tax collection now and begin collecting taxes going forward. You may also pay with an electronic funds transfer by ACH credit.

After a sales tax license has been issued the Tax. Counties and cities can charge an additional local sales tax of up to 24 for a. File the Utah Sales Tax Return You will do this through the Utah Taxpayer Access.

Only Oregon Montana New. Please contact us at 801-297-2200 or taxmasterutahgov for more. The free options are provided by reputable safe and secure providers and can help.

The countys total sales tax rate is. Check the Free Federal and State Tax Filing Sources above if youre looking for free filing methods.

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Utah Sales Tax Rate Rates Calculator Avalara

Utah Sales Tax Rate Rates Calculator Avalara

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Utah Income Tax Calculator Smartasset

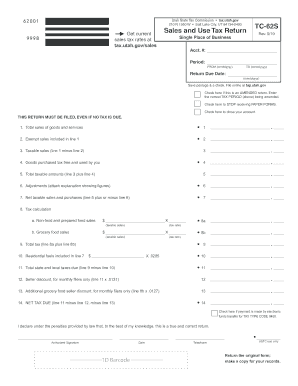

Utah Sales Use Tax Form Fill Out And Sign Printable Pdf Template Signnow

Utah State Tax Benefits Information

New Laws In 2019 Include Online Sales Tax For Out Of State Purchases

Fillable Online Utah Sales And Use Tax Return Tc 61 Fax Email Print Pdffiller

The Supreme Court Cleared The Way For Utah To Collect Sales Taxes From All Online Sales Here S What It Means For Consumers And Businesses